hawaii capital gains tax rate 2021

Read rest of the answer. View All 427 Images.

You Can Change Your Medicare Advantage Coverage Until March 31 Mcdowell News In 2022 Medicare Advantage Dental Insurance Plans Medicare

Capital gains tax is a 76 percent tax on capital gains in Hawaii.

. The capital gains tax rate reaches 765. Hawaiis capital gains tax rate is 725. Clear Form SCHEDULE D FORM N-40 REV.

Short-term capital gains are taxed at the full income tax rates listed above. This is your long-term capital loss carryover from 2021 to 2022. The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021.

Long-term capital gains come from assets held for over a year. 12 rows In Hawaii theres a tax rate of 14 on the first 0 to 2400 of income for single or. The bill has a defective effective date of July 1 2050.

Increases the capital gains tax threshold from 725 to 9. There is currently a bill that if passed would increase the. That applies to both long- and short-term capital gains.

In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above. Hawaiis 16 rate would apply to those earning more than 200000 a year. Increases the alternative capital gains tax for corporations from 4 to 5.

A capital gain will be taxed at. What Is The 2021 Capital Gains Tax Rate. California is currently the state with the highest income tax rate in the nation at 133 for individuals earning more than 1 million a year.

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate. Heres How Tax Increases Are Shaking Out In The Hawaii Legislature. 2021 STATE OF HAWAIIDEPARTMENT OF TAXATION Capital Gains and Losses 2021 Attach this Schedule to Fiduciary Income Tax Return Form N-40 Name of Estate or Trust PART I N40SCHD_I 2021A 01 VID01 Federal Employer Identification Number Short-term Capital Gains and Losses Assets Held One Year or Less a.

Capital Gains Tax in Hawaii. Long-term capital gains can apply a deduction of 30 or 60 for capital gains from the sale of farm assets. If zero or less enter zero.

House members take their oaths of office on. The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data. IWKLVLVWKHQDOUHWXUQRIWKHWUXVWRUGHFHGHQWVHVWDWH DOVRHQWHURQOLQH F 6FKHGXOH.

Capital Gains Tax Rates in Other States. The gains for which capital gains are recorded are long-term and short-term. That applies to both long- and short-term capital gains.

As for the other states capital gains tax rates are as. Hawaiis capital gains tax rate is 725. Applies for tax years beginning after.

1 increases the Hawaii income tax rate on capital gains from 725 to 9. 35 Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains. Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets.

Long-term gains are those realized in more than one year. Short-term capital gains come from assets held for under a year. You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year.

Hawaii Capital Gains Tax In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. Individuals with total taxable income between 40400 and 39400 will not be required to pay capital gains tax in 2021.

Long Term Capital Gains Tax Brackets for 2021 It should also be noted that taxpayers whose adjusted gross income is in excess of 200000 single filers or heads of household or 250000 joint filers may be subject to an additional 38 tax as a net investment income tax. 5 rows What Is The Capital Gains Rate For 2021. 2021 Hawaii State Sales Tax Rates The list below details the localities in Hawaii with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

Hawaii tax forms are sourced from the Hawaii income tax forms page and are updated on a yearly basis. Senators moved to raise income taxes on high earners and the House passed capital gains and inheritance tax increases. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital.

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. Based on filing status and taxable income long-term capital gains. House lawmakers have passed their own legislation raising the capital gains tax.

California is currently the state with the highest income tax rate in the nation at 133 for individuals earning more than. Tax on capital gains would be raised to 288 percent according to House Democrats. As an example if an individuals taxable income.

Wisconsin taxes capital gains as income. The capital gains tax rate reaches 875. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status.

Can You Avoid Capital Gains Taxes When Selling A Second Home Upnest

Everything In The House Democrats Budget Bill The New York Times

Tax Filing Tips For Hair Salons Barbers And Hairdressers Turbotax Tax Tips Videos

Income Tax Implications Of Moving From State To State

You Can Make 110 000 Flipping A House In Maryland Here Are The 10 Best States To Turn A Profit Flipping Houses Wyoming South Dakota

Long Term Investments Investing Finance Investing Value Investing

2022 Tax Brackets 2022 Federal Income Tax Brackets Rates

How Much Tax Do You Pay When You Sell A Rental Property

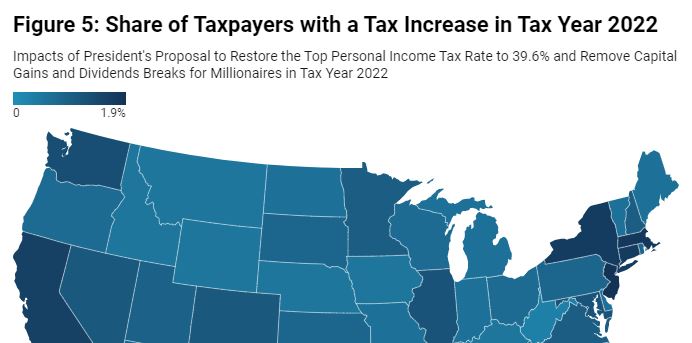

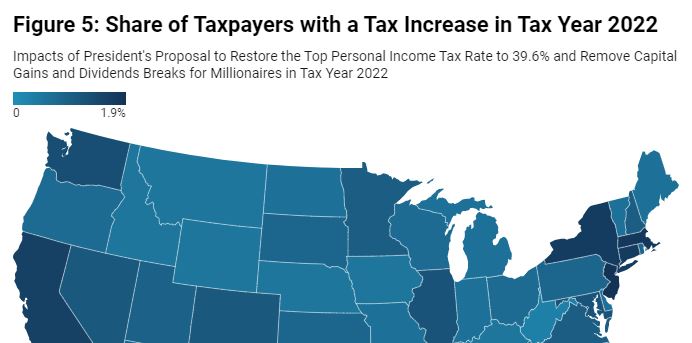

Income Tax Increases In The President S American Families Plan Itep

The Difference Between Sales Tax And Use Tax Affordable Bookkeeping Payroll Sales Tax Tax Bookkeeping

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Tax Proposals Under The Build Back Better Act Version 2 0

Capital Gains Tax Calculator 2022 Casaplorer

Lowest Highest Taxed States H R Block Blog

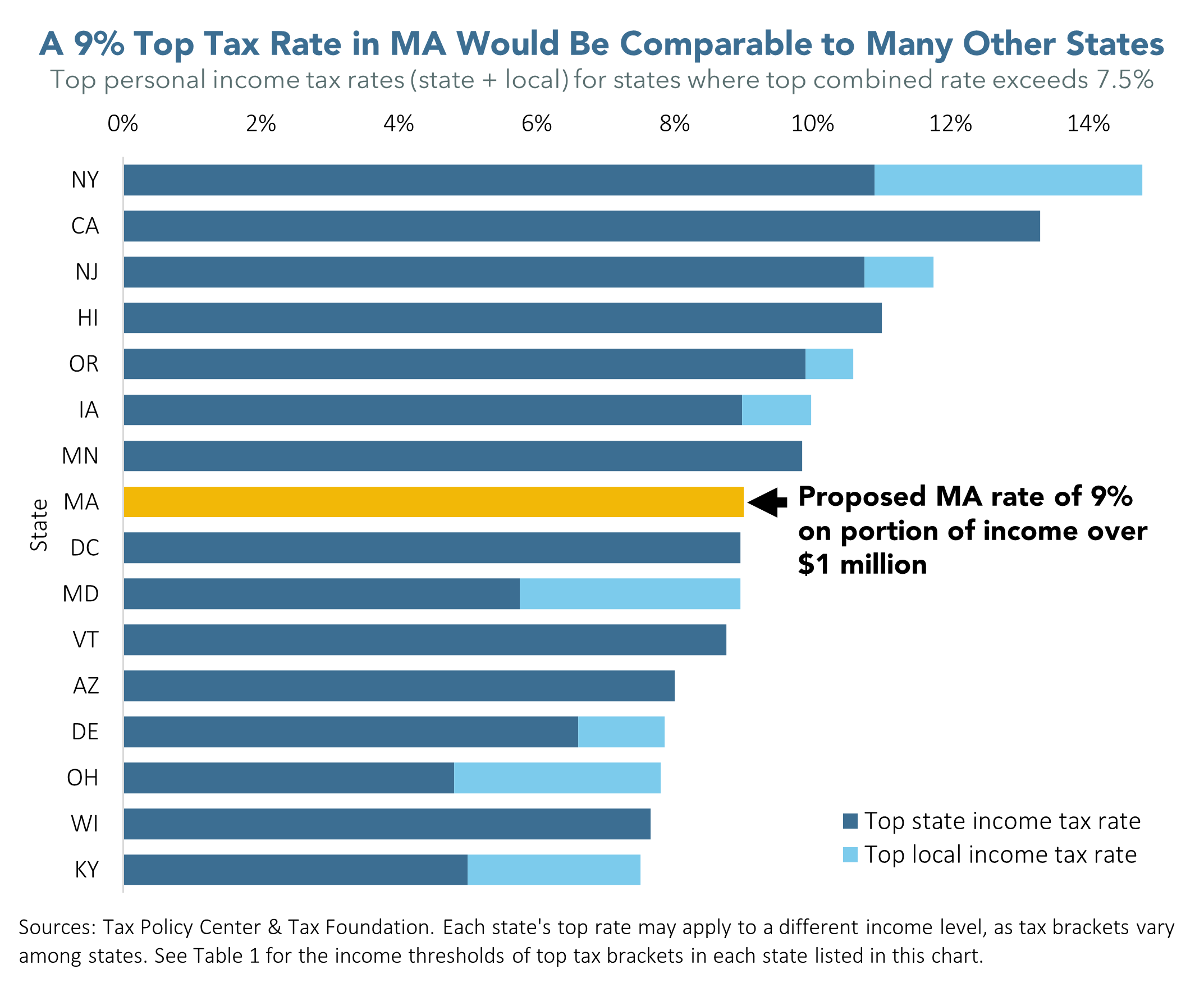

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

Everything In The House Democrats Budget Bill The New York Times